Paul B Insurance Medicare Insurance Program Huntington Things To Know Before You Get This

Transitioning from Covered California to Medicare is a vital step. Ensure you take activity as well as maintain track of crucial days as well as deadlines to prevent undesirable repercussions. In basic, individuals who are eligible for Medicare also if they do not enroll in it aren't eligible to obtain financial aid (premium tax credit scores) to decrease the price of a Covered California health and wellness strategy.

Your Covered The golden state strategy will not be automatically canceled when you end up being eligible for Medicare, even if you enlist in a Medicare strategy with the same insurance coverage business. You have to terminate your plan yourself at the very least 14 days before you want your protection to finish by contacting Covered California. paul b insurance insurance agent for medicare huntington. If you are eligible for Medicare and you keep your Covered The golden state strategy, you might deal with severe repercussions.

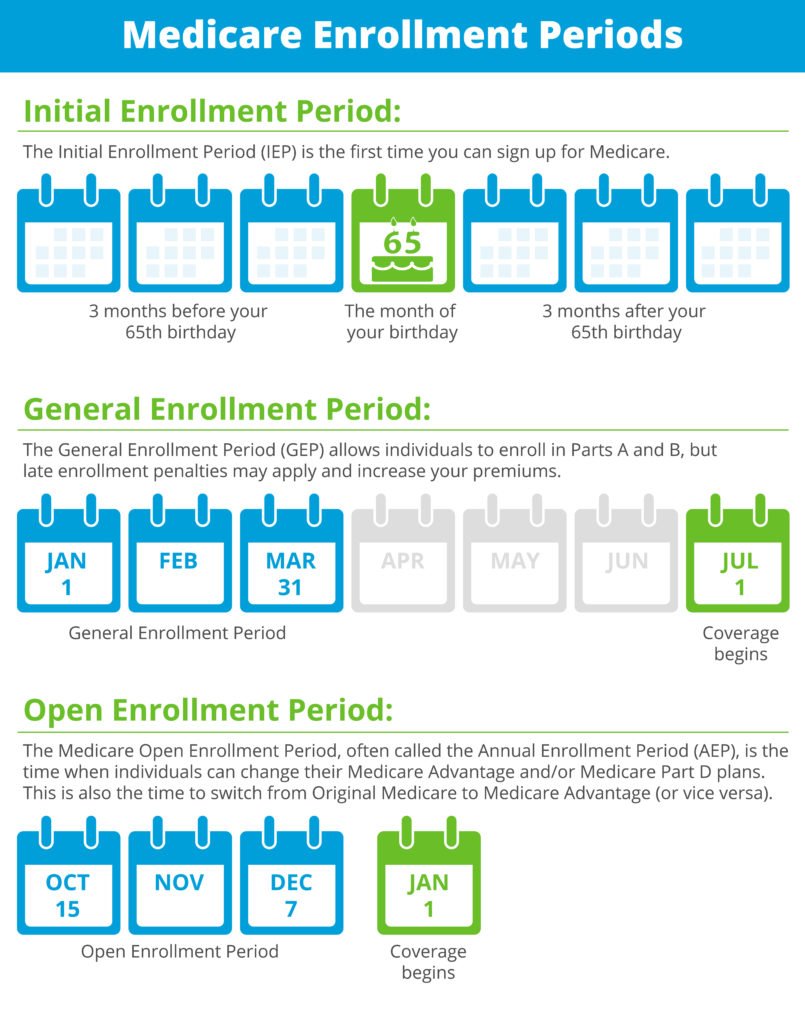

Or, there could be a hold-up in your Medicare protection start date. If you do not enroll in Medicare Part B (medical insurance policy) during your initial enrollment duration, you will certainly need to await the basic open registration duration (Jan. 1 to March 31), and after that your protection would not begin till July of that year.

Things about Paul B Insurance Medicare Agency Huntington

There is an exception for individuals eligible for costs Part A. If you need to pay for Medicare Part A, you might purchase a Covered The golden state health insurance rather than registering in Medicare Component A. You might likewise receive financial aid to lower your plan prices, relying on your revenue.

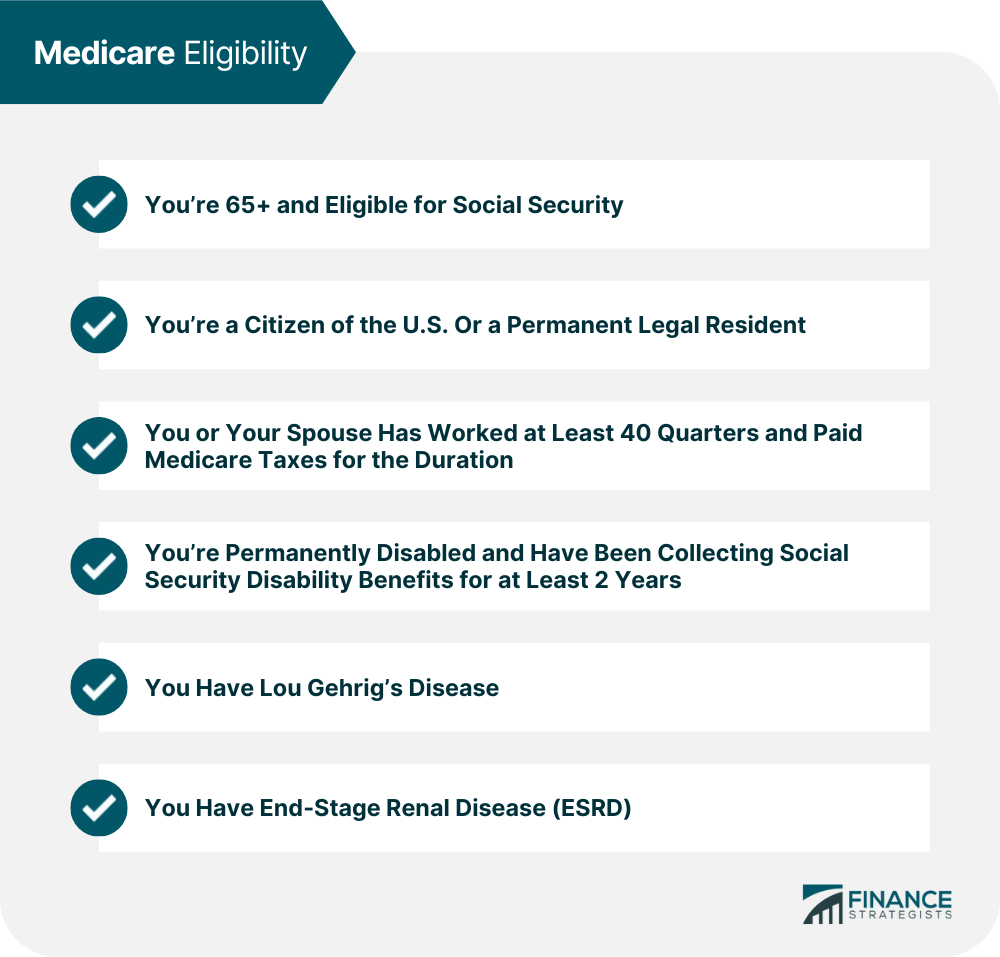

It is necessary to carefully analyze your choices. Individuals with a plan via Covered The golden state who have actually been figured out handicapped by the Social Safety Administration will be automatically enrolled in Medicare within 2 years of getting Social Safety Special needs Insurance Coverage (SSDI) income. You can buy health and wellness coverage via Covered The golden state during your two-year waiting period.

You will certainly no longer qualify for financial help to pay for your Covered California plan after your two-year waiting period ends. You will need to terminate your wellness strategy via Covered The golden state at least 14 days before you want your coverage to finish.

Call Covered The golden state at (800) 300-1506 (TTY: 888-889-4500) and also inform us regarding your Medicare coverage. If you're presently registered in Medicare Component A, or eligible for premium-free Medicare Component A, you can't sign up in new coverage with Covered California.

The Only Guide for Paul B Insurance Insurance Agent For Medicare Huntington

Depending on your income as well as assets, you may be qualified for extra protection via Medi-Cal. As soon as you're registered in Medicare, you can contact your regional region office or complete the Covered The golden state application to see if you additionally get Medi-Cal. Unless you presently obtain Social Safety benefits, Medicare registration is manual, and also you must proactively enroll.

The initial registration period starts three months before the month you transform 65 and it ends 3 months after the month you transform 65. You need to authorize up for some Medicare components before the month you turn 65 to avoid a health and wellness coverage gap. If you miss your initial registration duration, you might have to wait up until the general open-enrollment period in January to authorize up, with insurance coverage not beginning up until July of that year.

This might also imply that you 'd need to pay a greater Medicare premium for the remainder of your life. The Social Safety Management can inform you if you're eligible for Medicare, if you need to pay a premium for Component A (health center insurance policy), as well as when your protection begins. h0609 027 Call the Social Safety Administration at (800) 772-1213.

You should call Covered The golden state at (800) 300-1506 (TTY: 888-889-4500) as quickly as you understand your Medicare qualification and start day. To avoid a space in insurance coverage or tax charges, call Covered The golden state as soon as you discover out concerning your Medicare eligibility verification from the Social Safety And Security Management, but before your Medicare coverage begin day.

The Facts About Paul B Insurance Insurance Agent For Medicare Huntington Revealed

If you currently have a Covered California plan and become eligible for premium-free Medicare Part A (healthcare facility insurance policy), you can maintain your current Covered site here The golden state strategy, yet you will have to pay the full cost. You have to report your Medicare eligibility to Covered California within 30 days of coming to be eligible.

If you have to pay a costs for Part A, you may keep your Covered California plan and get financial help if eligible, rather of Medicare Component A however not both. Nevertheless, their eligibility should go with the determination medicare supplement plan n process once again, which may alter the quantity of economic assistance they can obtain.

Medicare additionally supplies Medigap, which is exclusive extra insurance that helps pay for some healthcare costs like copayments, coinsurance, and also deductibles. You need to apply for Medigap within 6 months of signing up in Medicare Component B (medical insurance).

:max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png)